Legislative Update: April 2025

April 7, 2025

While the legislature has not been operating at 100% for the last week, your legislative team has been working overtime: meeting with legislators, assisting in crafting & tracking legislation and testifying at the Capitol. A flurry of bills in the House and Senate are making it through the legislative process since committee deadlines are April 11th. View the bills affecting CRE that NAIOP is tracking »

Since the state budget forecast worsened, Governor Walz was required to release an updated budget. He preserved new programs passed last biennium and cut long standing programs. He proposed raising over $200 million through sales tax expansion to individual accounting, legal, banking, title search and investment services. He lowered the state tax slightly-for every $100, sales taxes go down 7 cents—whoopee, don’t spend it all at once! Most of us pay additional local sales taxes which means your professional services would go up 9% or more, making these services provided by out-of-state providers more attractive. Roz testified in opposition to the sales tax expansion in the Minnesota Senate on March 25th and the House on April 2nd.

TAXES

Catalyst for Underutilized Buildings (CUB) Credit

HF 457-Rep. Harder / SF 768-Sen. Mohamed

Chad Tepley with CDT Realty Corporation & Roz testified in support and shared some concerns in the details such as a 5-year vacancy requirement and updating the language from “conversion” to “adaptive reuse”. We are working with the bill authors and stakeholders to advocate for these minor but impactful changes.

CRED iQ research puts the Minneapolis-St. Paul-Bloomington market leading the nation out of the top 50 markets for distressed commercial real estate properties at a 49.7% distress rate. This is a percentage of properties whose loans are delinquent or in special servicing—meaning they may be performing but in violation of special covenants like DSCR (Debt Service Coverage Ratio) or vacancy. Obviously, some of our larger buildings downtown are weighing down the market; however, all other cities are recovering a lot faster. To provide perspective, the overall distress rate for all loans across every market was 10.8% as of February.

5th Tier 12.45% individual income and corporate tax rate increase was introduced, which would make Minnesota the second highest rate behind California but effective at a lower threshold of income, and second highest corporate rate behind New Jersey.

Also heard in the Senate Taxes committee was a proposal to have a 50% gross receipts tax on the manufacturing and retail sale of products containing PFAS.

PROPERTY TAX APPEALS

Data Privacy Protections & 30-day remedy period after August 1st deadline—After several years of working on language with all stakeholders, HF 2959-Rep. Scott was introduced and heard in the House Judiciary Finance and Civil Law committee. Gauri Samant with Fredrikson & Byron and Lane Thor with Ryan testified in support of the bill. The private details of leases should remain confidential if property taxes are appealed and go to court. Also, this bill allows petitioners a 30-day remedy period to get minor missing information to the assessor after the August 1st deadline instead of being pushed out another year.

CONTRACTORS

Several pieces of legislation have been introduced aimed at independent contractors along with doubling the fees for misclassifying employees as independent contractors. Here are some making their way through the legislative process:

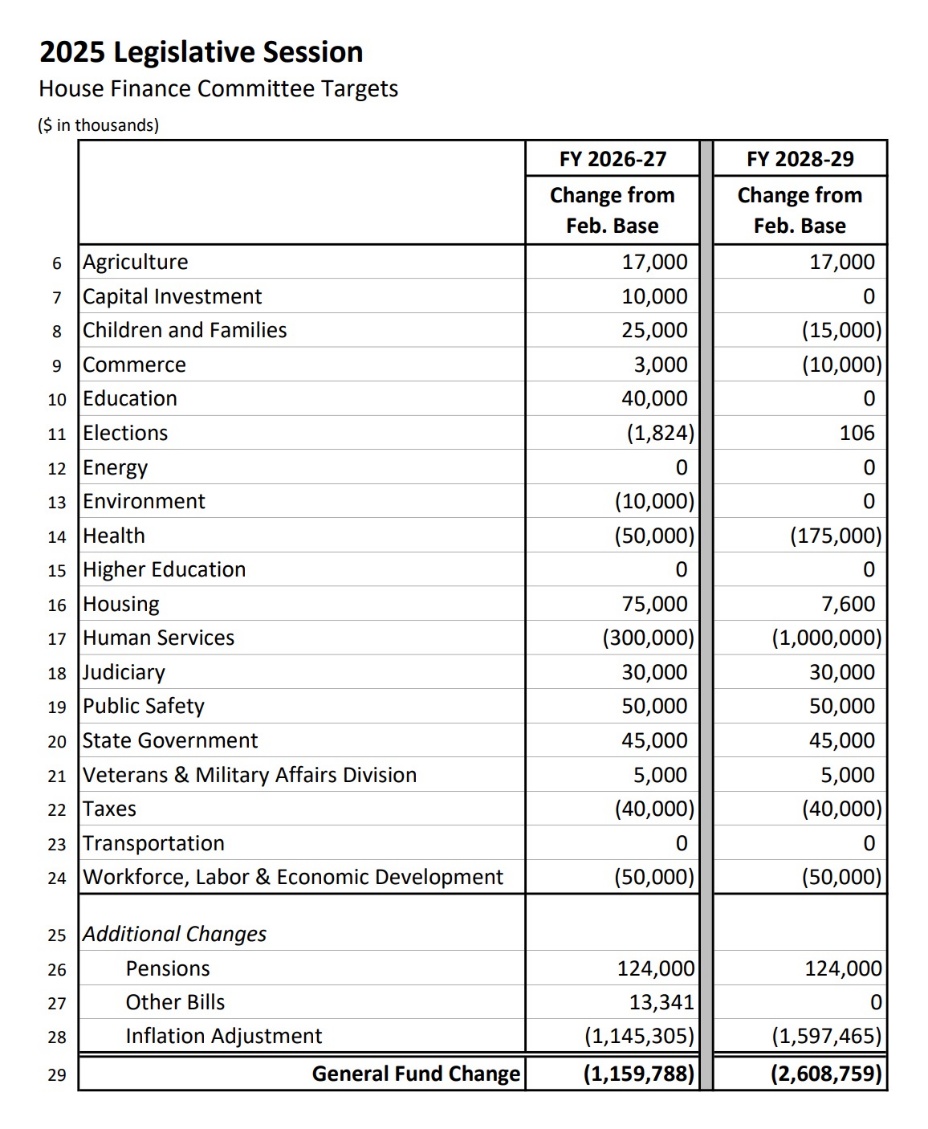

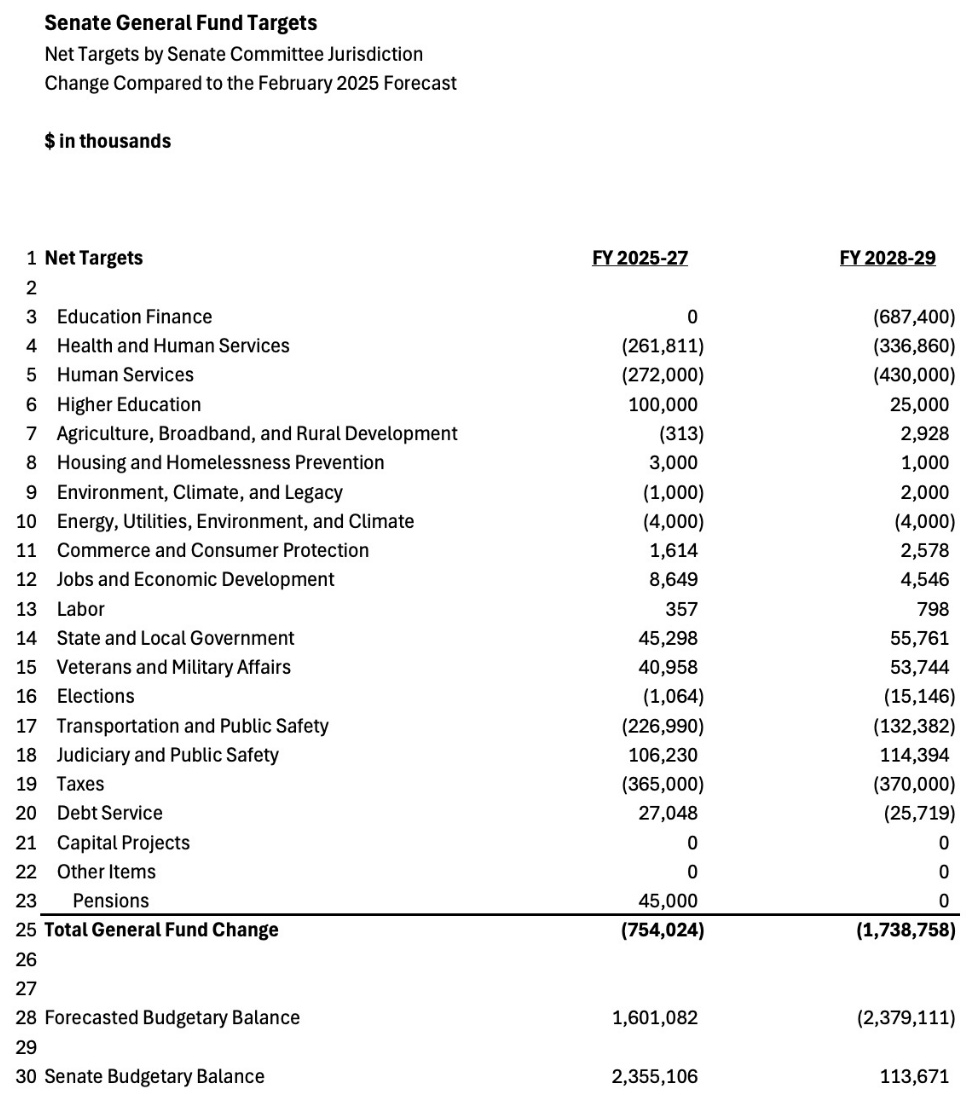

BUDGET TARGETS

The Senate released their budget targets which provides the framework for the committee omnibus bills. The largest cuts are for health & human services and transportation & public safety, along with tax increases as well as increases for higher education, state & local government, pensions, & veterans. In the next biennium, cuts to education are added. The House has differing perspectives as does the Governor.

LOBBYIST DEFINITION EXPANSION

SF 2562-Sen. Westlin clarifies “expert witness” and adopts Campaign Finance Board’s recommendations. HF 2284-Rep. Coulter was amended and both were laid over for possible inclusion in an omnibus bill.

If you have any feedback or additional concerns, please don’t hesitate to reach out to me or our team. We are all looking forward to the legislative break after April 11th!