CRE Sentiment Index: Industry Leaders’ Outlook for Commercial Real Estate

May 4, 2023

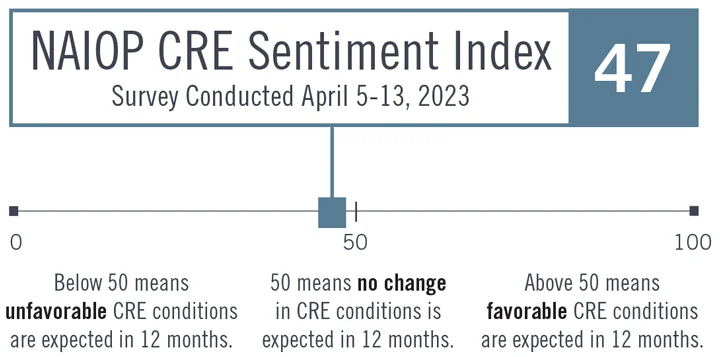

NAIOP's Sentiment Index is designed to predict general conditions in the commercial real estate industry over the next 12 months by asking industry professionals to predict conditions for their own projects and markets.

The NAIOP CRE Sentiment Index for April 2023 is 47, matching September 2022’s reading, and indicating that respondents expect conditions for commercial real estate to worsen over the next 12 months.

Key takeaways:

- Respondents expect debt and equity to be less available in the future and for cap rates to rise.

- Commercial real estate practitioners also forecast a decline in occupancy rates and a slight decline in effective rents.

- Developers and building owners also predict that economic conditions will be slightly less favorable in the markets in which they are active, suggesting a more challenging operating environment.

- Reflecting growing concern about market conditions, developers and building owners expect to initiate a smaller volume of new projects and acquisitions over the next year. They project a sharper decline in the dollar value of these projects than in any previous survey since this question was first asked in March 2020.

- Most respondents (54.3%) expect to be most active in projects or transactions related to industrial properties over the next year. Multifamily properties attracted the next-largest share of interest (31.7%), followed by office properties (7.5%) and retail properties (6.5%).

- For the first time since the survey’s inception, respondents do not expect construction material costs to rise over the next year. They continue to predict that construction labor costs will increase, though at a slower rate than previously predicted.

Read the report »