New Report: Class A Buildings Lead the Stabilization of the Office Market

May 20, 2022

The NAIOP Research Foundation has published the NAIOP Office Space Demand Forecast for Q2 2022.

Key Takeaways

- Office market vacancy rates increased for the 10th straight quarter to start the year, but a look inside the numbers reveals that the completion of new office product is partially responsible.

- Class A buildings are driving net absorption rates in many parts of the country, such as the Sun Belt, and firms consider quality office space necessary to attract skilled employees. Suburban markets and life sciences hubs are recovering better than the national average as more employers embrace a return to the office and the pandemic eases.

- Leasing activity is up year over year, which signals that firms are more comfortable making longer-term commitments to office space. Property owners have been willing to offer greater tenant improvements to encourage signing, indicating that tenants still have the upper hand in lease negotiations. These signals indicate a move toward a more stable equilibrium as the office market finds its balance.

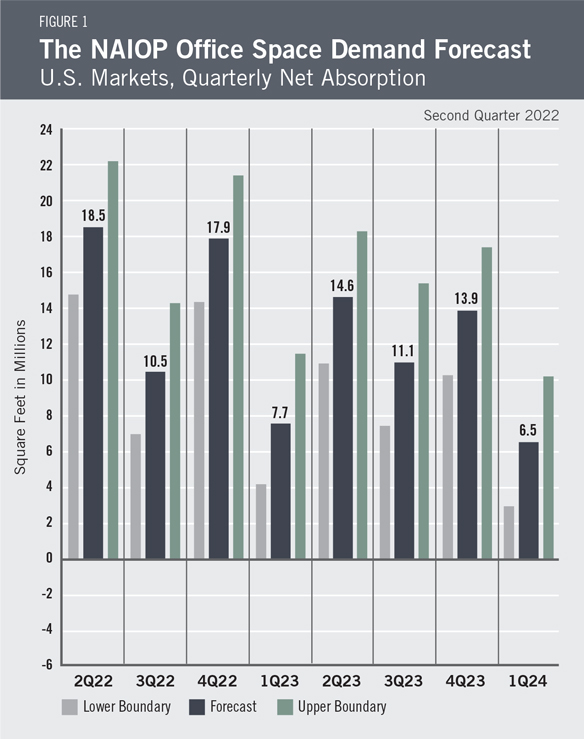

- Given these trends and signs of a slowing – but still growing – economy, net office space absorption in the remaining three quarters of 2022 is forecast to be 46.9 million square feet, essentially unchanged from the previous forecast for these quarters (46.6 million square feet).

- Total net absorption in 2023 is forecast to be 47.3 million square feet, with an additional 6.5 million square feet absorbed in the first quarter of 2024.

Read the report »