Industrial Space Demand Forecast, Third Quarter 2020

August 24, 2020

COVID-19 Spurs Demand for E-Commerce, but Recession Produces Headwinds for Industrial Real Estate

By: Dr. Hany Guirguis, Manhattan College and Dr. Timothy Savage, New York University

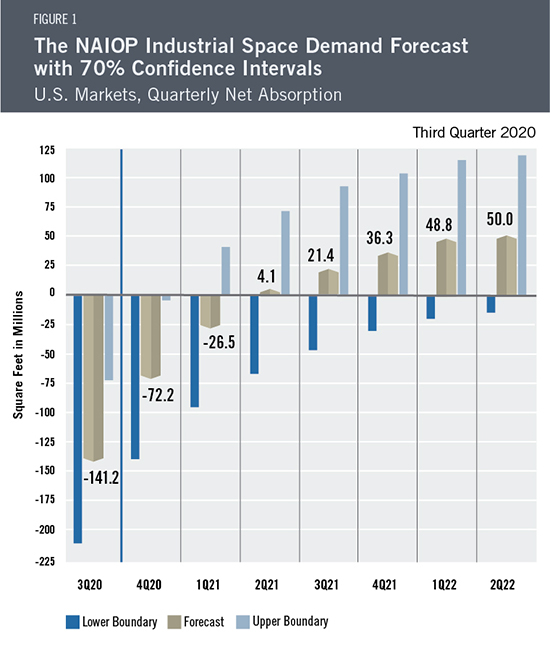

The U.S. macroeconomic landscape has deteriorated significantly since NAIOP’s February 2020 Industrial Space Demand Forecast. Most notably, the economy entered a recession that is likely to continue through the end of the year. Although industrial real estate has outperformed other commercial property types this year due to a surge in e-commerce, broader macroeconomic indicators suggest industrial space absorption will decline sharply in Q3 2020 and then rebound to positive levels in Q2 2021 (see Figure 1).

Although the pandemic will likely increase demand for e-commerce, it is unlikely that industrial real estate will be completely immune from the effects of the coronavirus-induced recession. These include significant disruptions to supply chains and global trade, reduced manufacturing and construction activity, and widespread store closures among brick-and-mortar retailers. These trends and the overall decline in economic activity are likely to impair the performance of industrial properties that are not well-positioned for e-commerce distribution. Employment in U.S. warehousing and storage in July remained 2.3% lower than its peak in March, suggesting that while the sector has fared better than the economy as a whole, it is still recovering.

Read the full report »